Before the foreclosure crisis got its legs in Florida and around the nation, back in 2006, 2007 and mostly 2008, I

Before the foreclosure crisis got its legs in Florida and around the nation, back in 2006, 2007 and mostly 2008, I

Elusive principal reductions are hard to come by, but we recently scored a very big win on behalf of one of our prior foreclosure clients turned Chapter 13 client. This week Ocwen agreed to a reduction in principal from $130,000 to $49,000 at 2.625% interest. This family’s principal and interest payment dropped to $224. Escrow is anticipated at another $200 for taxes and insurance.

Elusive principal reductions are hard to come by, but we recently scored a very big win on behalf of one of our prior foreclosure clients turned Chapter 13 client. This week Ocwen agreed to a reduction in principal from $130,000 to $49,000 at 2.625% interest. This family’s principal and interest payment dropped to $224. Escrow is anticipated at another $200 for taxes and insurance.

This Bartow, Polk County, Florida family had lost their employment in 2008. By the time they obtained new employment nearly two years had passed and a foreclosure lawsuit was filed by MERS as nominee for Home 123 Corporation in 2008. A HAMP mod was denied during the foreclosure process. Prior to a foreclosure judgment being entered, the family filed a Chapter 13 in a final effort to keep their home. One of the problems was that the arrearage was $31,000 all of which had to be paid in the five year Chapter 13 plan. Moreover the home was valued now at $50,000 per the most recent tax assessment while $130,000 was owed on the home on a first mortgage. In bankruptcy, we as debtor’s counsel filed an objection to the Proof of Claim on the basis that proper documentation was not filed. Missing endorsements demonstrated a lack of standing on behalf of the mortgage company, among other problems.

A couple weeks before trial, we arranged a conciliation conference with opposing counsel and their client. Our clients were again considered for a HAMP modification which was denied a second time. We offered a new amortizing mortgage of $50,000 at 30 years at 5% interest. Ocwen came forward with an independent modification of something even better: $49,000 at 2.625 %. Payment $224 plus escrow. Hard to beat. Clients jumped at the offer needless to say.

To give credit where credit is due, I have no idea how much of this was because of Ocwen or because of our stellar legal wrangling 🙂 I have heard of Ocwen reducing principal elsewhere in the nation, but have seen no reports locally. In an article in DSNews.com a site for those in the mortgage default servicing industry, Ocwen has explained in their experience negative equity increases the likelihood of a re-default 1.5 to 2 times and that approximately 15 percent of all Ocwen loan modification involve some element of principal reduction.

Continue reading →

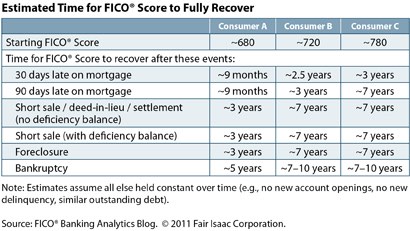

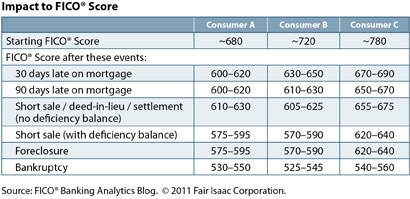

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.

A recent article by FICO, Banking Analytics Blog, researched these very questions.

The FICO study focused on three sample consumers with credit scores of 680, 720 and 780. As shown by the charts above, the answer depends a lot on what the existing credit score is. The higher your score is, the longer it appears to fully recover. However, after 18 months of otherwise good credit, this impact may be minimized.

In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed Florida Statute 222.25(4) what is referred to as the “wildcard” exemption which allows an additional $4,000 exemption for personal property when the homeowner is not claiming the homestead exemption. Florida judges have determined that the exemptions can be stacked and now homeowners who do not claim the homestead exemption can keep up to $5,000 in personal property.

In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed Florida Statute 222.25(4) what is referred to as the “wildcard” exemption which allows an additional $4,000 exemption for personal property when the homeowner is not claiming the homestead exemption. Florida judges have determined that the exemptions can be stacked and now homeowners who do not claim the homestead exemption can keep up to $5,000 in personal property.

This year, the Florida Supreme Court in Osbourne v. Dumoulin, No. SC09-751 ruled that a homeowner can claim the wildcard exemption even though they are keeping their home when it has no equity. Some judges were already ruling in this manner. As a result, many attorneys began to claim the $4,000 wildcard exemption and avoided claiming the home as exempt. Trustees were not interested in the home because it had no equity so there was no need to claim the homestead exemption.

Seeing the profit potential, some companies have begun to contact the Chapter 7 trustees in the Tampa Bay area and offering to buy the bankruptcy estate’s interest in the homes where no homestead exemption is claimed. Their goal is for the approximate $2,000 that they pay the trustee, the real estate firm will then put the house up for a short sale where they make a few bucks, and charge the homeowner rent in the meantime. The homeowner gets blindsided when they intended to keep the home all along.

In a new incentive program beginning in late 2010, Chase is purportly offering $10,000 to $20,000 to homeowners who take the effort to short sale their property. The offer includes a waiver of any deficiency balance. But it only applies to loans actually owned by Chase, not just serviced by Chase. An article in the St. Pete Times today discusses the program in more depth. Chase is apparently providing approvals in approximately 35 to 40 days after an offer is made, while most short sales take at least six months to conclude.

In a new incentive program beginning in late 2010, Chase is purportly offering $10,000 to $20,000 to homeowners who take the effort to short sale their property. The offer includes a waiver of any deficiency balance. But it only applies to loans actually owned by Chase, not just serviced by Chase. An article in the St. Pete Times today discusses the program in more depth. Chase is apparently providing approvals in approximately 35 to 40 days after an offer is made, while most short sales take at least six months to conclude.

This is opposite of a growing trend of banks and servicers refusing to grant deficiency waivers.

Many loans are actually owned by Freddie Mac or Fannie Mae now though. To check if your loan is owned by Fannie Mae or Freddie Mac, go to the Freddie look-up site and Fannie look-up site which provide an instant answer. No guarantees that the sites are accurate although in our experience they usually are accurate (even though the loan documentation may still be up for challenge do to failures and inconsistencies in the paperwork).

One other way to possibly see who purports to own and service your loan is the MERS look up site.

So if your servicer is Chase and you are unable to continue making your house payments and a modification seems out of reach or doesn’t make sense, use the look up sites above to try and identify if Chase is only the servicer, or if they are also the owner of your loan. You can also call Chase directly and ask if Chase owns your loan or if they are merely servicing it for an investor. Ask who the investor is if possible. The more knowledgeable you are, the more you will know what options are available to you.

There are other more exact methods of determing the owner of your loan as well.

Continue reading →

We have noticed here in the Tampa Bay, Florida legal community that written deficiency waivers of the unpaid loan balances for first mortgages are getting harder to come by. A recent St. Petersburg, Florida Times article focuses in on the potential landmine: “People have no idea of all the trouble that is coming” says Margery Golant, a lawyer in Broward County who sees deficiency defense cases on the rise. Florida is known as a recourse state and the lenders have a right to obtain a personal judgment for the remaining unpaid balance. They then can seek to collect that debt by garnishing wages or bank accounts or placing a lien on other property that the debtor owns.

This is true of short sales regardless of lender. It is also true of deed in lieu or other voluntary return of the property through a consent judgment in rem (which means against the property only). Even Freddie Mac has aggressively pursued new reduced promissory notes in short sales.

What does this mean? We think it means someone will come knocking to collect that debt eventually. It might be five years down the road (prior to the expiration of the statute of limitations), but if the lender obtains a deficiency judgment, like any judgment it can be collected for 10 years and renewed for a second 10 year period. In the State of Florida, a judgment creditor has 20 years to try and collect an unpaid judgment.

Sheila Blair, FDIC chairman, announced Friday a new proposal to resolve the foreclosure fraud issues that have arisen, particularly in Florida, a judicial foreclosure state. It is being presented as a settlement of the fraudulent issues by the five major mortgage servicers. The nation-wide “cash for keys” program would provide homeowners up to $21,000 to voluntarily leave their home. I would presume that the program would require the homeowner to also waive any legal rights and claims against the mortgage company.

Interesting idea. Now the homeowner would have the funds to pay a down payment on a new performing loan on probably a less costly and more affordable home. Somehow they would be expected to qualify for financing despite the hit their credit will take giving up the present home.

Please note this is only a proposal (not a law or anything yet), and the banks strongly object to it. It is being targeted to only those homeowners who are 90 or more days delinquent. It is a step toward winding down HAMP which is expected to occur in the next year or two. Other proposals being discussed may include a menu of options available to a servicer including “cash for keys” or principal write down. There are a number of parties involved though for an agreement to be reached. The parties raising claims include the Department of Justice, all 50 state attorney-general, various banking regulators, the FDIC, the Treasury, and the new Consumer Financial Protection Bureau. You then have an industry full of banks and mortgage servicers on the other side.

Continue reading →

Currently, the Bankruptcy Code does not allow a bankruptcy court to modify a bankruptcy debtor’s first mortgage on his or her primary home. It does not prevent a mortgage company from modifying a loan if it voluntary agrees, but nothing allows the bankruptcy judge the power to force a principal reduction for an underwater home.

Currently, the Bankruptcy Code does not allow a bankruptcy court to modify a bankruptcy debtor’s first mortgage on his or her primary home. It does not prevent a mortgage company from modifying a loan if it voluntary agrees, but nothing allows the bankruptcy judge the power to force a principal reduction for an underwater home.

It has been this Tampa Bay law firm’s opinion that eventually principal reductions will become more widespread. It has been reported that banks now hold only 15% of the nation’s home mortgages, and that the remainder are now owned by Freddie Mac, Fannie Mae and numerous securitized trusts. When this mess first began, banks held a much larger percentage of home loans which have now been transferred to Fannie and Freddie. I believe the banks should have been forced to eat the loans they made, but I digress. At least now the nation is in a position to permit principal reductions because it is much less likely to crash the five major banks.

NACBA (National Association of Consumer Bankruptcy Attorneys) has announced a proposal to address the dilemma of underwater homes. This new proposal, the Principal Paydown Plan, would provide:

1) Interest rate reductions to 0% for the first mortgage to allow the entire monthly mortgage loan payment to go directly to principal;

2) During a five year plan, the borrower’s minimum monthly housing payment would be calculated similar to a HAMP modification payment at 31% of gross income;

3) At the end of the five year period, the remaining principal balance would be amortized over 25 years at the Freddie Mac survey rate (running approximately 4.75% now);

4) The bankruptcy judge and Chapter 13 trustee would approve of the eligibility of the borrower and feasibility of the payments, something that they presently do in all Chapter 13 cases;

5) The borrower agrees to a general settlement of all claims against the lender and servicer and avoiding title and loan litigation.

Continue reading →

Finally, a win in the Florida Supreme Court for bankruptcy debtors. In February, the Osbourne v. Dumoulin decision puts to rest an issue in Florida where judges disagreed on how much personal property a debtor could keep when filing bankruptcy. Generally a debtor using Florida state exemptions can keep $1,000 in personal property. They can retain additional personal property, but they have to pay to keep anything above the exempt amount. However, if a Florida debtor is not claiming a homestead exemption, they can claim a larger $4,000 wildcard exemption to protect additional personal property such as bank accounts, equity in vehicles etc.

Finally, a win in the Florida Supreme Court for bankruptcy debtors. In February, the Osbourne v. Dumoulin decision puts to rest an issue in Florida where judges disagreed on how much personal property a debtor could keep when filing bankruptcy. Generally a debtor using Florida state exemptions can keep $1,000 in personal property. They can retain additional personal property, but they have to pay to keep anything above the exempt amount. However, if a Florida debtor is not claiming a homestead exemption, they can claim a larger $4,000 wildcard exemption to protect additional personal property such as bank accounts, equity in vehicles etc.

Even our four bankruptcy judges in Tampa, Florida disagreed on how to apply the wildcard exemptions in cases where the home was underwater. After Dumoulin, in cases where the debtors own a home that has negative equity, they can now claim an additional $4,000 wildcard exemption to keep additional personal property. This can be very valuable since Florida’s personal property exemptions are one of the lowest in the country. Most people haven’t minded too much because Florida’s homestead and IRA/401k exemptions are very favorable to debtors. But nowadays, many people have negative home equity and have cashed out or borrowed against their 401ks and don’t receive the benefit of those broad exemptions.

Application of exemptions can be complicated especially in cases where the debtor has recently moved from another state, please consult with an attorney regarding the proper use of exemptions. Arkovich Law

On March 9, 2011, Bank of America Corp. (BAC) announced it is segregating its good and bad mortgages into two separate entities. After swallowing Countrywide, Bank of America is America’s biggest lender with 13.9 million mortgages. Often referred to as being too big to fail, frankly it is also too big to manage its mortgage loans competently and effectively as shown time and time again in our foreclosure defense practice.

On March 9, 2011, Bank of America Corp. (BAC) announced it is segregating its good and bad mortgages into two separate entities. After swallowing Countrywide, Bank of America is America’s biggest lender with 13.9 million mortgages. Often referred to as being too big to fail, frankly it is also too big to manage its mortgage loans competently and effectively as shown time and time again in our foreclosure defense practice.

The riskiest and worst performing “legacy” loans total approximately 6.7 million loans and include those that are currrently 60 or more days delinquent. It also includes those loans often referenced as toxic loans (negative amortizing loans, interest only, Alt-A, and subprime loans). Roughly, this totals approximately $1 trillion dollars.

Keep in mind BOA has approxmately $148 billion in equity. This equates to 15% of the $1 trillion dolllars of impaired assets. BOA is obviously and unquestionably insolvent. The FDIC should have locked the doors already. Some enterprising person or entity should consider filing an involuntary bankruptcy petition for them.