Articles Posted in Uncategorized

Post Bankruptcy — Don’t Just Pay – Often a Collections Law Violation!

We received this inquiry today from a fellow bankruptcy attorney:

We received this inquiry today from a fellow bankruptcy attorney:

I have a client who had a Chapter 13, which due to it being a 100% plan, ended off paying off the Proof of Claim Amount at 100% in the bankruptcy.

Years later, (Insert Private Student Loan Company Here) is coming back after her arguing that during the bankruptcy, interest continued to accrue, and now she owes $3,700 in interest. In the Chapter 13 Trustee’s Final Account they paid the POC principal PLUS interest.

Florida Foreclosure Help

The FHA Covid-19 Forbearances allow for reduced or suspended payments without specific terms of repayment, for six months at a time, up to 18 months. Deadline for applications was May 11, 2023. The end of the health emergency is now over. If you’ve lost your income, job change or divorce for instance, you may have qualified for this relief.

The FHA Covid-19 Forbearances allow for reduced or suspended payments without specific terms of repayment, for six months at a time, up to 18 months. Deadline for applications was May 11, 2023. The end of the health emergency is now over. If you’ve lost your income, job change or divorce for instance, you may have qualified for this relief.

A FHA Covid-19 Modification is called Advance Loan Modification. If a mortgage loan is in forbearance, the review will occur within 30 days of forbearance ending. For those mortgage loans are not in forbearance, if the loan is 90 plus days delinquent it must be reviewed for a modification offer on or before 10/30/2024. This is still in effect!

January 2023 new guidelines: a substantial change is that the guidance now applies for non-occupied borrowers. Some other notes:

Fighting Foreclosure of a HELOC?

Lenders will often try to get a note and mortgage into evidence with a simple endorsement in blank of the promissory note. This can be defeated.

Lenders will often try to get a note and mortgage into evidence with a simple endorsement in blank of the promissory note. This can be defeated.

The mortgage is the issue.

A mortgage follows a “note” but a mortgage does not follow a non-negotiable instrument. Since Florida Statutes Ch. 673 does not apply, the transfer of the mortgage is governed by chapter 679, which requires a written assignment. The attempted transfer of the non-negotiable instrument should be ignored.

Workspace for Rent!

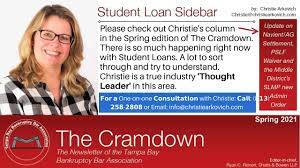

Our new Student Loan Sidebar is up Now!

We write a column – that has become 1-2 pages due to all the stuff going on — called the Student Loan Sidebar in our local Cramdown publication to all bankruptcy practitioners including debtor attorneys, the creditors’ bar and our judiciary.

We write a column – that has become 1-2 pages due to all the stuff going on — called the Student Loan Sidebar in our local Cramdown publication to all bankruptcy practitioners including debtor attorneys, the creditors’ bar and our judiciary.

Because not everyone has access to this publication, we also have a copy added to our home page of our website. Here is the Spring Sidebar:

https://www.christiearkovich.com/files/student-loan-summer-2023.pdf

Bankruptcy Audits have Resumed March 13, 2023

The United States Trustee Program (USTP) has resumed audits of individual chapter 7 and chapter 13 bankruptcy cases under the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 on March 13 ,2023.

The United States Trustee Program (USTP) has resumed audits of individual chapter 7 and chapter 13 bankruptcy cases under the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 on March 13 ,2023.

What does this mean if your case is selected?

The USTP contracts with independent firms, utilizing certified public accountants and independent licensed public accounts, to perform audits of individual chapter 7 and chapter 13 cases randomly selected by the USTP. The purpose of the audit is to determine the accuracy, veracity, and completeness of petitions, schedules, and other information required to be provided by the debtor under sections 521

SouthTampaWorkspaces.com

Our ad came out in the Hillsborough County Lawyer Magazine today for our new Workspaces in South Tampa. Yay! During the pandemic when our team started working remotely, we fully renovated our office space to offer a “sometimes” office as needed for both us and our colleagues. We offer several different packages, from a simple mailbox/reception services to a place to sit with a laptop, an office (with a door!) a few days a month with some conference room time, to a fixed office that only you occupy. Come and go as you please with your door code, easy online reservations and payment, free ample parking and lots of services like high speed scanning, wide-screen monitors, shredding and notary, extra comfy and professional desk/chairs, sitting areas, a pub kitchen and more! Come and check us out if you are a professional/attorney and are in need of a place to be occasionally or full-time!

Our ad came out in the Hillsborough County Lawyer Magazine today for our new Workspaces in South Tampa. Yay! During the pandemic when our team started working remotely, we fully renovated our office space to offer a “sometimes” office as needed for both us and our colleagues. We offer several different packages, from a simple mailbox/reception services to a place to sit with a laptop, an office (with a door!) a few days a month with some conference room time, to a fixed office that only you occupy. Come and go as you please with your door code, easy online reservations and payment, free ample parking and lots of services like high speed scanning, wide-screen monitors, shredding and notary, extra comfy and professional desk/chairs, sitting areas, a pub kitchen and more! Come and check us out if you are a professional/attorney and are in need of a place to be occasionally or full-time!

We’re a little different than a larger co-working space because we understand the needs of our attorneys, have cross-referral networking opportunities, and don’t nickel and dime the small stuff. Also, no binding year long contract.

SouthTampaWorkspaces.com – more pics and pricing.

Would you Pay $2,500 to Finally Get Rid of your Federal Student Loans in Bankruptcy?

“It is now time”, states Judge Klein who is charting a path for discharging student loans without being reversed. For years, bankruptcy judges were wary of ruling in favor of debtors who asked for a discharge of federal student loan debt. In part, because those Judges knew their rulings would be appealed by either the Department of Education, or ECMC (guarantor litigator for the older FFEL loans). Now it’s different.

“It is now time”, states Judge Klein who is charting a path for discharging student loans without being reversed. For years, bankruptcy judges were wary of ruling in favor of debtors who asked for a discharge of federal student loan debt. In part, because those Judges knew their rulings would be appealed by either the Department of Education, or ECMC (guarantor litigator for the older FFEL loans). Now it’s different.

In an opinion just out on April 5 (Love v U.S. Dep’t of Education, Fedloan Servicing, Nelnet; Adv. 21-02045-C), Judge Klein decried the “widespread belief that student loans are virtually impossible to discharge in bankruptcy.” Now there is an attestation process, whereby a debtor can use factors like:

- School closure

Avoid Foreclosure – Be Aware of New Amended Procedure That Will Act as a Gag Order

I know I posted about this before, but it bears repeating as I fear many homeowners will lose their home to foreclosure if they don’t know about this very important rule change last summer.

I know I posted about this before, but it bears repeating as I fear many homeowners will lose their home to foreclosure if they don’t know about this very important rule change last summer.

Important new change for opposing MFSJ for those living in Florida. Don’t expect to just show up at the hearing and argue — this rule will prevent anything you say from helping you.

Take a look at the 4th Circuit case which I believe is the first ruling on the amended MFSJ rule. Page 4: https://www.4dca.org/content/download/839898/opinion/212397_DC05_06082022_101625_i.pdf

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog