In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed Florida Statute 222.25(4) what is referred to as the “wildcard” exemption which allows an additional $4,000 exemption for personal property when the homeowner is not claiming the homestead exemption. Florida judges have determined that the exemptions can be stacked and now homeowners who do not claim the homestead exemption can keep up to $5,000 in personal property.

In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed Florida Statute 222.25(4) what is referred to as the “wildcard” exemption which allows an additional $4,000 exemption for personal property when the homeowner is not claiming the homestead exemption. Florida judges have determined that the exemptions can be stacked and now homeowners who do not claim the homestead exemption can keep up to $5,000 in personal property.

This year, the Florida Supreme Court in Osbourne v. Dumoulin, No. SC09-751 ruled that a homeowner can claim the wildcard exemption even though they are keeping their home when it has no equity. Some judges were already ruling in this manner. As a result, many attorneys began to claim the $4,000 wildcard exemption and avoided claiming the home as exempt. Trustees were not interested in the home because it had no equity so there was no need to claim the homestead exemption.

Seeing the profit potential, some companies have begun to contact the Chapter 7 trustees in the Tampa Bay area and offering to buy the bankruptcy estate’s interest in the homes where no homestead exemption is claimed. Their goal is for the approximate $2,000 that they pay the trustee, the real estate firm will then put the house up for a short sale where they make a few bucks, and charge the homeowner rent in the meantime. The homeowner gets blindsided when they intended to keep the home all along.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Traditionally in Florida, doing a short sale rather than allowing a foreclosure sale to occur is considered much better for your credit. Not so much difference in credit score per se, but mostly for future governmental financing when it is time to buy a home again.

Traditionally in Florida, doing a short sale rather than allowing a foreclosure sale to occur is considered much better for your credit. Not so much difference in credit score per se, but mostly for future governmental financing when it is time to buy a home again. Short sales are good for a number of reasons:

Short sales are good for a number of reasons:  The late night fiscal cliff tenative workout included a proposed extension of the Mortgage Debt Relief Forgiveness Act for one more year to include 2013! Floridians seeking to short sale their home but weren’t able to get it done prior to the end of 2012 can breathe a sigh of relief. It’ll take a few days, but provided the House approves the Senate’s Bill, it will be full speed ahead for short sales for another year.

The late night fiscal cliff tenative workout included a proposed extension of the Mortgage Debt Relief Forgiveness Act for one more year to include 2013! Floridians seeking to short sale their home but weren’t able to get it done prior to the end of 2012 can breathe a sigh of relief. It’ll take a few days, but provided the House approves the Senate’s Bill, it will be full speed ahead for short sales for another year.

When listing and selling a home in a short sale, homeowners should consider including language to limit recovery of any unpaid amounts by the mortgage company (known as the deficiency balance). In Florida, we recommend this limitation be placed in the Purchase and Sale Contract. This way when the lender/bank agrees to the short sale, they are in essence agreeing to the terms of the contract between the buyer and seller. It is no different than if you wrote in “as-is” to limit your liability as to the condition of the property. I’d recommend something like the following be inserted into the contract:

When listing and selling a home in a short sale, homeowners should consider including language to limit recovery of any unpaid amounts by the mortgage company (known as the deficiency balance). In Florida, we recommend this limitation be placed in the Purchase and Sale Contract. This way when the lender/bank agrees to the short sale, they are in essence agreeing to the terms of the contract between the buyer and seller. It is no different than if you wrote in “as-is” to limit your liability as to the condition of the property. I’d recommend something like the following be inserted into the contract:

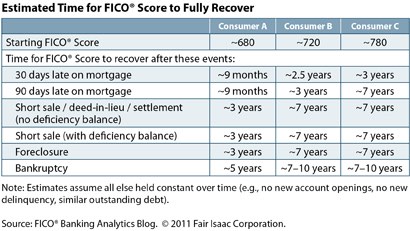

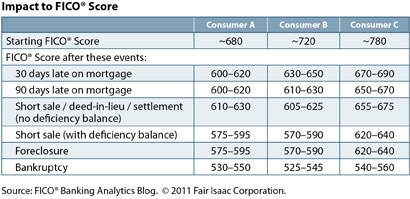

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy. In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed

In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed  In a new incentive program beginning in late 2010, Chase is purportly offering $10,000 to $20,000 to homeowners who take the effort to short sale their property. The offer includes a waiver of any deficiency balance. But it only applies to loans actually owned by Chase, not just serviced by Chase. An

In a new incentive program beginning in late 2010, Chase is purportly offering $10,000 to $20,000 to homeowners who take the effort to short sale their property. The offer includes a waiver of any deficiency balance. But it only applies to loans actually owned by Chase, not just serviced by Chase. An