When listing and selling a home in a short sale, homeowners should consider including language to limit recovery of any unpaid amounts by the mortgage company (known as the deficiency balance). In Florida, we recommend this limitation be placed in the Purchase and Sale Contract. This way when the lender/bank agrees to the short sale, they are in essence agreeing to the terms of the contract between the buyer and seller. It is no different than if you wrote in “as-is” to limit your liability as to the condition of the property. I’d recommend something like the following be inserted into the contract:

When listing and selling a home in a short sale, homeowners should consider including language to limit recovery of any unpaid amounts by the mortgage company (known as the deficiency balance). In Florida, we recommend this limitation be placed in the Purchase and Sale Contract. This way when the lender/bank agrees to the short sale, they are in essence agreeing to the terms of the contract between the buyer and seller. It is no different than if you wrote in “as-is” to limit your liability as to the condition of the property. I’d recommend something like the following be inserted into the contract:

The sale of this property is contingent upon the lender’s acceptance of all sale/purchase contract terms including a complete discharge/forgiveness of debt of any remaining deficiency amounts on the loan. Accordingly, the bank’s acceptance of this short sale agreement will constitute payment in full of both the first and second mortgage notes on this property and represent a waiver of any future lender right to pursue an action and/or judgment against the owners/borrowers to recover any deficiency amounts arising from this short sale transaction.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

The special foreclosure courts in HIllsborough county are shutting down the end of this week. Does this mean the foreclosure crisis is finally at an end? Not exactly.

The special foreclosure courts in HIllsborough county are shutting down the end of this week. Does this mean the foreclosure crisis is finally at an end? Not exactly. It has been my practice to advise clients to remain current on their Homeowners Association dues (HOA) even though they are behind or in foreclosure on their first mortgage. Today, an

It has been my practice to advise clients to remain current on their Homeowners Association dues (HOA) even though they are behind or in foreclosure on their first mortgage. Today, an  Have you been considering walking away from your house payments and mortgage? According to a recent

Have you been considering walking away from your house payments and mortgage? According to a recent  Elusive principal reductions are hard to come by, but we recently scored a very big win on behalf of one of our prior

Elusive principal reductions are hard to come by, but we recently scored a very big win on behalf of one of our prior

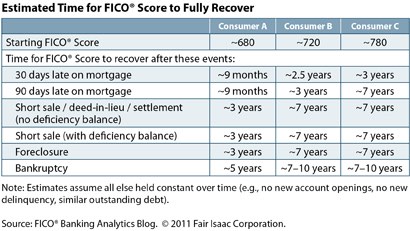

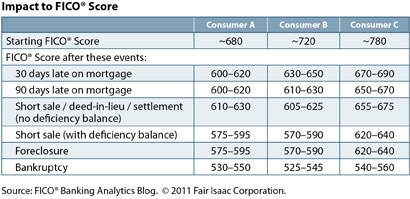

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy. Currently, the Bankruptcy Code does not allow a bankruptcy court to modify a bankruptcy debtor’s first mortgage on his or her primary home. It does not prevent a mortgage company from modifying a loan if it voluntary agrees, but nothing allows the bankruptcy judge the power to force a principal reduction for an underwater home.

Currently, the Bankruptcy Code does not allow a bankruptcy court to modify a bankruptcy debtor’s first mortgage on his or her primary home. It does not prevent a mortgage company from modifying a loan if it voluntary agrees, but nothing allows the bankruptcy judge the power to force a principal reduction for an underwater home. On March 9, 2011, Bank of America Corp. (BAC) announced it is segregating its good and bad mortgages into two separate entities. After swallowing Countrywide, Bank of America is America’s biggest lender with 13.9 million mortgages. Often referred to as being too big to fail, frankly it is also too big to manage its mortgage loans competently and effectively as shown time and time again in our foreclosure defense practice.

On March 9, 2011, Bank of America Corp. (BAC) announced it is segregating its good and bad mortgages into two separate entities. After swallowing Countrywide, Bank of America is America’s biggest lender with 13.9 million mortgages. Often referred to as being too big to fail, frankly it is also too big to manage its mortgage loans competently and effectively as shown time and time again in our foreclosure defense practice.