In Florida, typically someone who is sued is served with the lawsuit and given 20 or sometimes 30 days to file a response. If the lawsuit was filed in small claims court, you are given a date to appear at a pretrial conference instead of filing a written response.

In Florida, typically someone who is sued is served with the lawsuit and given 20 or sometimes 30 days to file a response. If the lawsuit was filed in small claims court, you are given a date to appear at a pretrial conference instead of filing a written response.

The most important thing is: Don’t ignore the deadline. It doesn’t matter that you think you might be able to work it out or that you called the attorney’s office who filed the lawsuit. If you don’t file a timely written response with the court, or attend the pretrial conference, a default will be entered against you. A default judgment can last up to 20 years in Florida and is very hard to challenge.

Before the deadline expires, please see an attorney. Many attorneys, including our office offer a free consultation for foreclosure defense or debt collection matters.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Do this to Stop Calls to your Cell Phone.

Do this to Stop Calls to your Cell Phone. In a strong opinion favoring Florida homeowners, the Eleventh Circuit slammed the door in the face of debt collectors and mortgage servicers in foreclosure cases making it abundantly clear that calling homeowners multiple times in one day after they have hired an attorney to represent them, using abusive and offensive language and lying about foreclosure sale dates and other unscrupulous behavior would no longer be tolerated. In

In a strong opinion favoring Florida homeowners, the Eleventh Circuit slammed the door in the face of debt collectors and mortgage servicers in foreclosure cases making it abundantly clear that calling homeowners multiple times in one day after they have hired an attorney to represent them, using abusive and offensive language and lying about foreclosure sale dates and other unscrupulous behavior would no longer be tolerated. In  Debt collectors excel at taking advantage of student loan borrowers by misrepresenting the law and options available to borrowers.

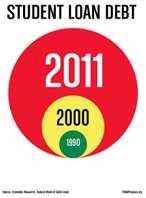

Debt collectors excel at taking advantage of student loan borrowers by misrepresenting the law and options available to borrowers. For the first time ever, student loan debt has surpassed credit card debt as student loan debt reaches the $1 trillion mark per a recent

For the first time ever, student loan debt has surpassed credit card debt as student loan debt reaches the $1 trillion mark per a recent  Many bankruptcy debtors in Florida are understandably confused when they surrender their home in the bankruptcy, but are still receiving various dunning letters.

Many bankruptcy debtors in Florida are understandably confused when they surrender their home in the bankruptcy, but are still receiving various dunning letters.  The Middle District of Florida, Tampa Division, upheld Wells Fargo’s practice of freezing bank accounts of Chapter 7 bankruptcy debtors.

The Middle District of Florida, Tampa Division, upheld Wells Fargo’s practice of freezing bank accounts of Chapter 7 bankruptcy debtors.  I don’t know about you, but I always have my cell phone with me. While fortunately I do not have debt collectors calling me on my cell phone, a lot of my clients here in the Tampa Bay area are troubled by this every day. Many report receiving several calls per day from the same debt collector. Come on, if a person doesn’t have the money in the morning, are they really going to have it in the afternoon, or even an hour later? Realistically, these calls are meant to do one thing: harass you into paying the debt.

I don’t know about you, but I always have my cell phone with me. While fortunately I do not have debt collectors calling me on my cell phone, a lot of my clients here in the Tampa Bay area are troubled by this every day. Many report receiving several calls per day from the same debt collector. Come on, if a person doesn’t have the money in the morning, are they really going to have it in the afternoon, or even an hour later? Realistically, these calls are meant to do one thing: harass you into paying the debt.