I’ve written quite a bit recently about the Department of Education’s recent announcements to halt the accrual of interest and collections of certain federal loans. Direct Loans and some FFEL loans are automatically being placed in forbearance until September 30, 2020.

Articles Posted in Creditor Harassment and FDCPA

Paycheck Protection Program (PPP) out of funds — Did Banks Do Everything They Could to Process These Loans on behalf of their Loyal and Long Term Customers?

Despite early applications and full financial documentation (sometimes submitted within hours of portals opening), some banks, who will remain nameless for now, dropped the ball and did not timely process PPP applications on behalf of scores of small businesses who had been loyal customers for years. I am one of these such businesses in Tampa Bay, Florida.

So I’m beginning to ask myself, what did these banks who failed their customers have to gain – while they strung the little guys along? If I had known my application would sit untouched for two weeks, I could have gone elsewhere, I have several banking relationships. But I chose to stay with the one application I filed with my primary banker. I counted on that bank. I was let down. Many more share my story.

I will soon have to draw down my line of credit at approximately 8% interest. That money goes to my bank – those funds will help their bottom line. These banks have profited by “dropping the ball”. Many small businesses will fail. Local businesses. Mom and pops. Despite filing an early application with a trusted banker.

Bank or Wages Garnished Unexpectedly?

My first consult this week was for a former client who just learned of a bank garnishment of his joint bank account with his wife from an old Cach final judgment that he thought was vacated and dismissed. The entire account was frozen. Plus his wife’s next check couldn’t be stopped from being deposited and taken.

How did he learn of this? When he was at the grocery store to buy food for his family in the midst of the COVID-19 crisis. After carefully avoiding everyone and loading his cart with what he could find – he walked away with nothing. He didn’t have money to pay us, but since we had been compassionate to him in the past, he thought, why not contact us, perhaps there is something we could do.

Fortunately, we were able to secure with the opposing attorney, a dissolution of the writ of garnishment and all the money in his joint bank account will be released in just a day or two. In the meantime, our client has borrowed some funds from a neighbor. This could happen to anyone — this client had no idea that this old judgment was out there, and that bank account was his emergency fund. He lost his job in Europe and had no credit cards. His wife works at a local Tampa Bay retailer and just had her hours cut. I sincerely appreciate opposing counsel who timely communicated with me in this urgent matter to get it resolved now and without the necessity of a court hearing, which could take a few weeks!

How to Avoid Arbitration Clauses in Consumer Contracts — Bankruptcy Court Can Help!

Are you looking down the barrel of an arbitration clause in your consumer/creditor agreement? I’ve posted before (Arbitration Clauses in Consumer Contracts – How to Avoid Being Thrown out of Court) on some local case law here in Florida to help avoid arbitration clauses – but here’s a new case in the consumer’s favor in Bankruptcy Court for the Middle District of Florida.

The Bankruptcy Court ruled that an arbitration clause did not constrain the court’s contempt powers, “[w]ords in a consumer agreement cannot deprive the bankruptcy court of the inherent power to enforce compliance with an injunction.” Verizon Wireless Personal Communications, LP v. Bateman, No. 14-5369, Adv. Pro. No. 18-1394 (M.D. Fla. Sept. 24, 2019).

So if you’re in bankruptcy, or had a previously filed one that you can reopen (without a filing fee), challenge the arbitration clause in bankruptcy – you may be much more likely to win!

When Does the FDCPA Come Into Play?

First off, to be covered under the Fair Debt Collection Practices Act, the debt must be a consumer debt.

- i.e. not a business debt.

- Examples are credit cards used for personal/household items; a home loan, a student loan, a phone bill/utility bill, dishonored personal check, rent etc.

How Exactly do I Revoke Consent to Call My Cell Phone?

I thought I’d take a minute to share common defenses faced by consumer lawyers such as myself — and help arm consumers with just how and what they should say to stop the calls.

First, a debt collector will always deny that you ever revoked consent to call. They will argue that you did not provide enough personal identifying information for them to verify and therefore they could not process the DO NOT CALL request.

Second, they will argue that the consumer did not specify which number he or she did not want the calls made to.

Help to Stop Robocalls

How many of us no longer answer our cell phone? With all the caller ID spoofing/disguising nowadays, most people I know don’t answer, opting instead for the caller to leave a voice message. This ensures they want to talk to the caller, and then they call back. The caller may do the same. I’m no different. Until someone is added into my address book, they don’t exist. Wasted time returning calls and listening to voice messages abounds.

Wouldn’t you like to see things turn around – and help make our cell phones useful for calls again?

The House just passed a near-unanimous bipartisan vote on the strongest anti-robocall legislation in decades. Everyone is sick of robocalls it seems. The Stopping Bad Robocalls Act now heads to the Senate, where similar but less comprehensive legislation was passed. But robocallers are hard at work lobbying Senators to scrap parts of the House legislation and significantly weaken its consumer protections. The consumer bar needs you to weigh in and insist the Senate keep key parts of the House rule intact to effectively stop unwanted robocalls.

Great New Opinions for Discharging Private Student Loan Debt in Bankruptcy

On January 31, 2019, Judge Stong of the Eastern District of New York denied the Motion to Dismiss filed by SLM Corporation, Sallie Mae, Inc., Navient Solutions, LLC and Navient Credit Finance Corp. In this Memorandum Decision, the Court dealt a blow to the private student loan defendants when it permitted Plaintiff to proceed with its case (note a Motion to Dismiss is a preliminary motion and the case is far from over). In re Homaidan, Adv. Pro. No. 17-01085 (E.D. N.Y. 2019).

On January 31, 2019, Judge Stong of the Eastern District of New York denied the Motion to Dismiss filed by SLM Corporation, Sallie Mae, Inc., Navient Solutions, LLC and Navient Credit Finance Corp. In this Memorandum Decision, the Court dealt a blow to the private student loan defendants when it permitted Plaintiff to proceed with its case (note a Motion to Dismiss is a preliminary motion and the case is far from over). In re Homaidan, Adv. Pro. No. 17-01085 (E.D. N.Y. 2019).

A nearly identical ruling was made the same day in In re Tashanna Golden, Adv. Pro. No. 17-01995 by the same Judge.

These cases dealt with Tuition Answer loans which the Plaintiff alleges are not “qualified education loan[s]” under the Bankruptcy Code Section 523(a)(8)(B), and for that reason, they were discharged in his Chapter 7 bankruptcy case. The Plaintiff argues that loans of this nature are excluded from the scope of his bankruptcy discharge and therefore any attempt to collect the debt after the bankruptcy discharge amount were impermissible and a violation of the discharge order.

Student Loan/Credit Card Debt Counterclaims have No Supplemental Jurisdiction in the Middle District of Florida

What happens to the original debt when a consumer files an unlawful debt collection lawsuit? Sometimes the creditor will file a counterclaim to force the underlying debt to judgment in an effort to turn the tide in favor of the debt collector.

What happens to the original debt when a consumer files an unlawful debt collection lawsuit? Sometimes the creditor will file a counterclaim to force the underlying debt to judgment in an effort to turn the tide in favor of the debt collector.

Fortunately, in the Middle District of Florida there are several good recent cases that prevent this outcome. The federal court has ruled there is no subject matter jurisdiction because there is no supplemental jurisdiction over the counterclaim based on the fact that the counterclaim is permissive and would substantially predominate over the plaintiff’s claims, and because the “set off” position didn’t support supplemental jurisdiction. See Della Vecchia v. Ally Financial, Inc., No. 8:17-cv-2977-T-23AAS, 2018 WL 907045 (M.D. Fla. Feb. 15, 2018); Vernell v. Ally Financial, Inc., et. al., No. 2:15-cv-674-FtM-38MRM, 2016 WL 931104, at *4 (M.D. Fla. Mar. 11, 2016).

This can be an important litigation concern that could force an early and minimal settlement if it weren’t for this case law favoring the consumer.

What to Look For In Hiring a Bankruptcy Attorney?

When you are thinking about hiring a bankruptcy attorney, what should you consider? – besides all the regular stuff like client reviews, years of practice, cost, availability, knowledgeable, friendliness of attorney and staff etc.

When you are thinking about hiring a bankruptcy attorney, what should you consider? – besides all the regular stuff like client reviews, years of practice, cost, availability, knowledgeable, friendliness of attorney and staff etc.

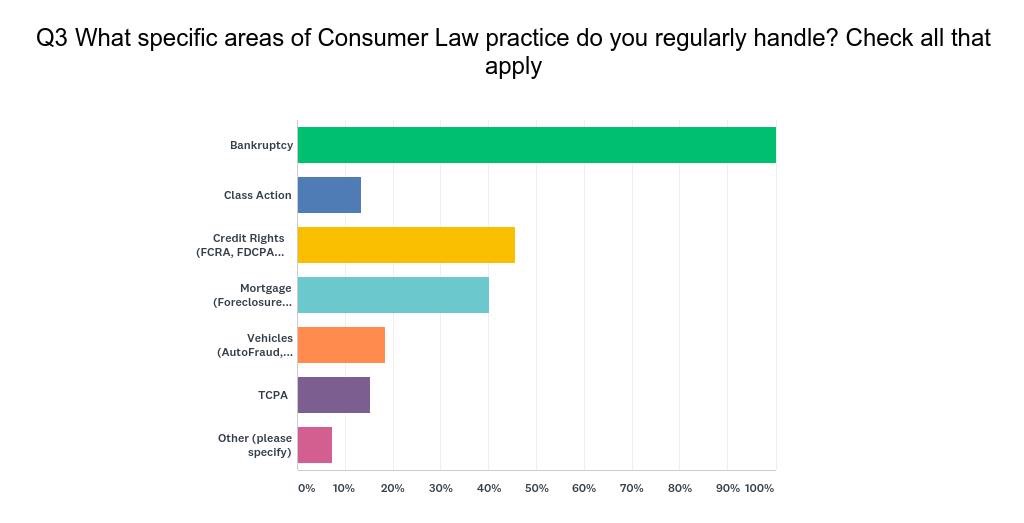

One thing to keep in mind is what other areas does that law firm handle and could that help you fix your situation. As you can see from the chart above, many bankruptcy attorneys just take bankruptcy cases. While that’s fine, most people facing a bankruptcy also have issues with their credit report, foreclosures, debt collection violations, robo calls, student loans etc. We handle all of that. We also have a class action team. One consumer area we don’t handle is vehicles – I don’t know a thing about our lemon laws or other issues regarding vehicles for instance.

I’m not suggesting you hire someone who dabbles in bankruptcy to file your bankruptcy. That is probably the worst thing you can do. But hiring a firm that is experienced in bankruptcy plus the other issues you are facing is probably best. We have over 25 years experience in bankruptcy plus a myriad of other consumer related issues commonly faced by our clients.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog