When you are thinking about hiring a bankruptcy attorney, what should you consider? – besides all the regular stuff like client reviews, years of practice, cost, availability, knowledgeable, friendliness of attorney and staff etc.

When you are thinking about hiring a bankruptcy attorney, what should you consider? – besides all the regular stuff like client reviews, years of practice, cost, availability, knowledgeable, friendliness of attorney and staff etc.

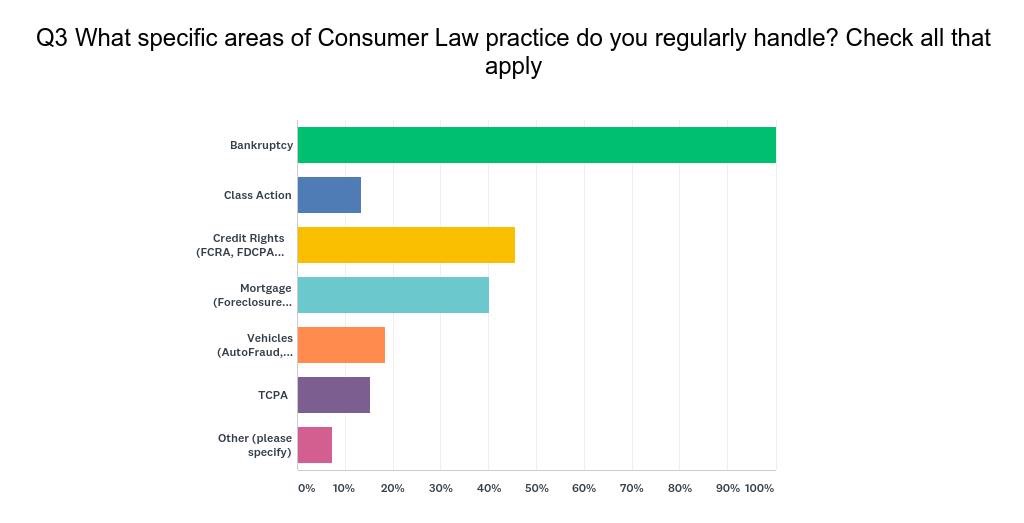

One thing to keep in mind is what other areas does that law firm handle and could that help you fix your situation. As you can see from the chart above, many bankruptcy attorneys just take bankruptcy cases. While that’s fine, most people facing a bankruptcy also have issues with their credit report, foreclosures, debt collection violations, robo calls, student loans etc. We handle all of that. We also have a class action team. One consumer area we don’t handle is vehicles – I don’t know a thing about our lemon laws or other issues regarding vehicles for instance.

I’m not suggesting you hire someone who dabbles in bankruptcy to file your bankruptcy. That is probably the worst thing you can do. But hiring a firm that is experienced in bankruptcy plus the other issues you are facing is probably best. We have over 25 years experience in bankruptcy plus a myriad of other consumer related issues commonly faced by our clients.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog