Our Florida clients sometimes ask me why they cannot strip off a second mortgage in a Chapter 7 like often done in a Chapter 13 bankruptcy nowadays. The limitation can be found in the United States Supreme Court’s decision in Dewsnup v. Timm, 502 U.S. 410, 417 (1992). The Court noted a distinction between the in rem and in personam claims created by a lien on a debtor’s property. The Court held that a Chapter 7 discharge of personal obligation leaves the in rem obligation intact against the property.

Our Florida clients sometimes ask me why they cannot strip off a second mortgage in a Chapter 7 like often done in a Chapter 13 bankruptcy nowadays. The limitation can be found in the United States Supreme Court’s decision in Dewsnup v. Timm, 502 U.S. 410, 417 (1992). The Court noted a distinction between the in rem and in personam claims created by a lien on a debtor’s property. The Court held that a Chapter 7 discharge of personal obligation leaves the in rem obligation intact against the property.

Even though a client might qualify to file a Chapter 7, sometimes the extra remedies available in a Chapter 13 make the more lengthy plan worthwhile. Under 11 U.S.C. 1322 a wholly unsecured second mortgage or HELOC can be stripped off a homestead. However, one other key difference exists between a Chapter 7 and 13. If a debtor retains a home in a Chapter 13, they are still personally liable for the first mortgage even if the second mortgage is stripped. Therefore, a Chapter 7 may still be best if the home is worth much less than the amount owed on a first mortgage and the debtor is uncertain about keeping the home long term.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Bankruptcy clients who are new to Florida come to our office complaining about what I call the Exemptions Calculus Problem. Learning calculus seems simpler. Below are some useful sites and a brief explanation as to how exemptions work.

Bankruptcy clients who are new to Florida come to our office complaining about what I call the Exemptions Calculus Problem. Learning calculus seems simpler. Below are some useful sites and a brief explanation as to how exemptions work. Have you been considering walking away from your house payments and mortgage? According to a recent

Have you been considering walking away from your house payments and mortgage? According to a recent

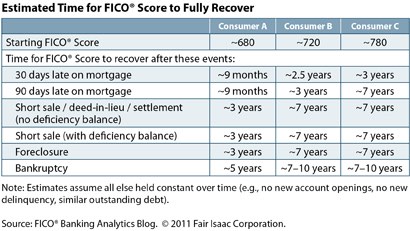

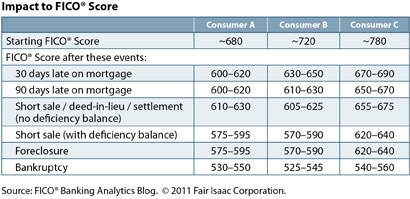

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy. In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed

In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed  Finally, a win in the Florida Supreme Court for bankruptcy debtors. In February, the

Finally, a win in the Florida Supreme Court for bankruptcy debtors. In February, the  The Middle District of Florida, Tampa Division, upheld Wells Fargo’s practice of freezing bank accounts of Chapter 7 bankruptcy debtors.

The Middle District of Florida, Tampa Division, upheld Wells Fargo’s practice of freezing bank accounts of Chapter 7 bankruptcy debtors.